What Does 7 Reasons to Steer Clear of Reverse Mortgages - Freedom Mean?

The title of the house remains in the debtor's name, so they are accountable for residential or commercial property taxes, energies, upkeep, and any other expenses. In Did you see this? , if you do not pay your real estate tax, your loan provider might require you repay your loan in complete. Some lenders may reserve a portion of your loan each year to be utilized to pay taxes and insurance.

During and after the reverse home loan, the home remains in the homeowner's name. In this method it is similar to conventional forward home loans. Can you still leave your home to your beneficiaries? Yes, however they will need to repay the loan balance prior to the title is complimentary and clear.

Unknown Facts About Las Vegas Reverse Mortgage lender

If they offer the house, they will need to pay either the balance of the loan or 95% of the home's assessed value (whichever is less). If you're interested in purchasing or refinancing a house in Las Vegas or accross Nevada, Mann Home loan can assist you make it occur. Please call us today or apply online in less than 10 minutes using the secure online application listed below.

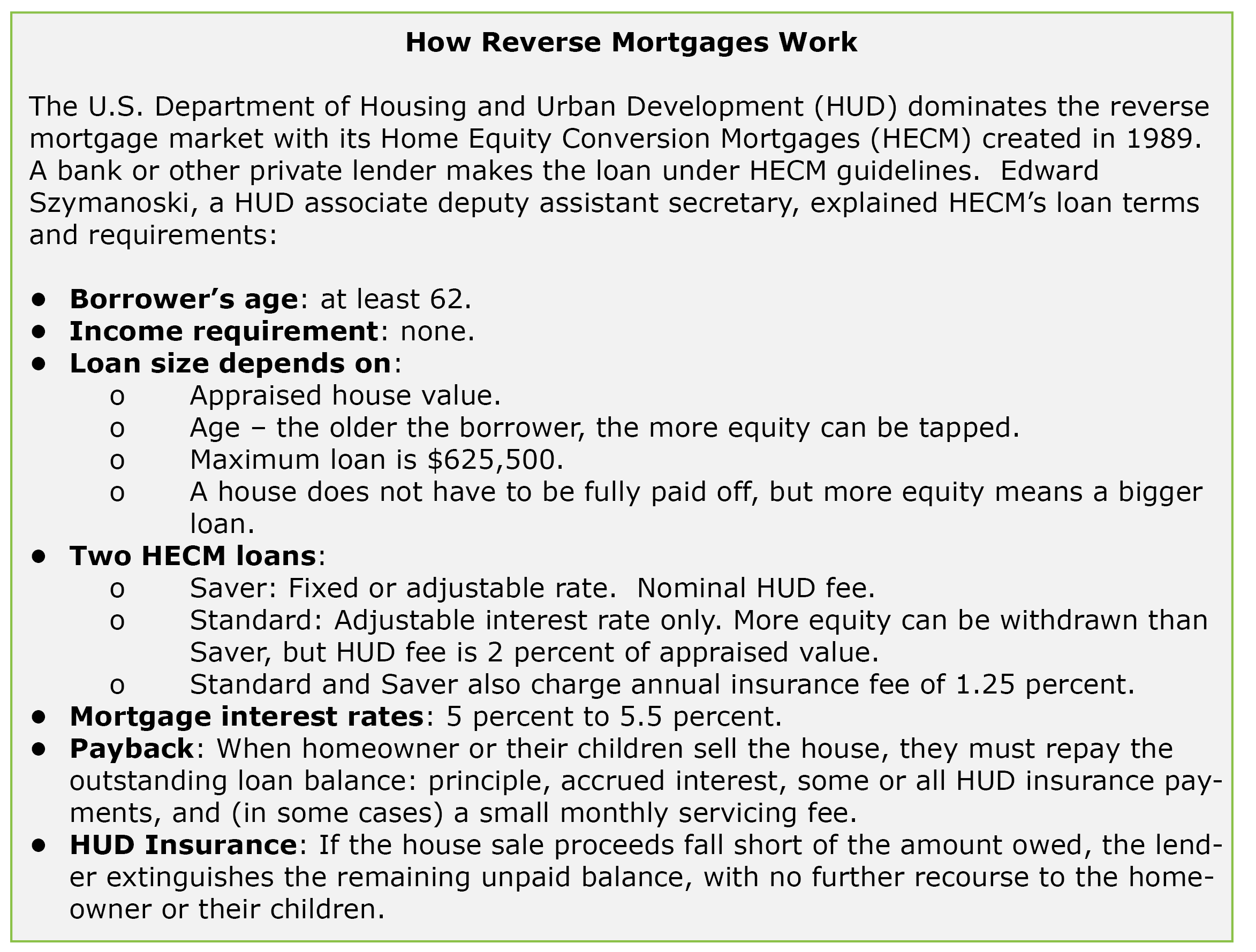

There are lots of kinds of home mortgage offered to property owners who have equity in their home, and a reverse home loan is one of these loans. Comprehending reverse home mortgages and how they work can assist homeowners who certify to choose whether a reverse home mortgage is for them. If you're a homeowner looking for a funding source or money to live on, here's what you need to know about reverse home mortgages.

The Facts About FHA Loan Limits for Silver-Springs, Lyon County, NV - Lendersa Uncovered

Always talk to a licensed home mortgage expert prior to proceeding with any real estate deal. What Is a Reverse Home loan? In addition, the homeowner should have a lot of equity and very little financial obligation on their existing home loan. The home must remain in good condition, and the property owner must be capable of paying their regular monthly mortgage and annual real estate tax.

There are various sort of reverse home mortgages. The amount of money